Learn More

What is Responsible Investment?

What is Responsible Investment?

Most investment has traditionally focused only on financial returns and risks. This means the financial world has been separated from the impacts that arise from investment decisions. The consequences of decisions like selling cigarettes to children or clear-cutting native forests have not been taken into account. If there is a good financial return, investors have ignored the real world impact.

Times have changed. We live on an increasing small and ecologically-stressed planet and there is rising concern over the impact of companies on individuals and communities. Consumers are now far more conscious about the impact of their purchases and governments are strengthening regulation.

There is also a growing movement of investors who understand the connection between investment and real world impact. They want their funds to avoid pollution or exploitation, and to invest in companies with high ethical standards.

The fledgling ethical investment movement has been super-charged by research showing that companies with higher standards also do well financially (see Returns section). Now the question is not "Why invest ethically?", it's "Why not?".

This movement is known variously as Ethical Investment, Responsible Investment or Socially Responsible Investment (SRI). These approaches take social and environment factors into account in investment decisions.

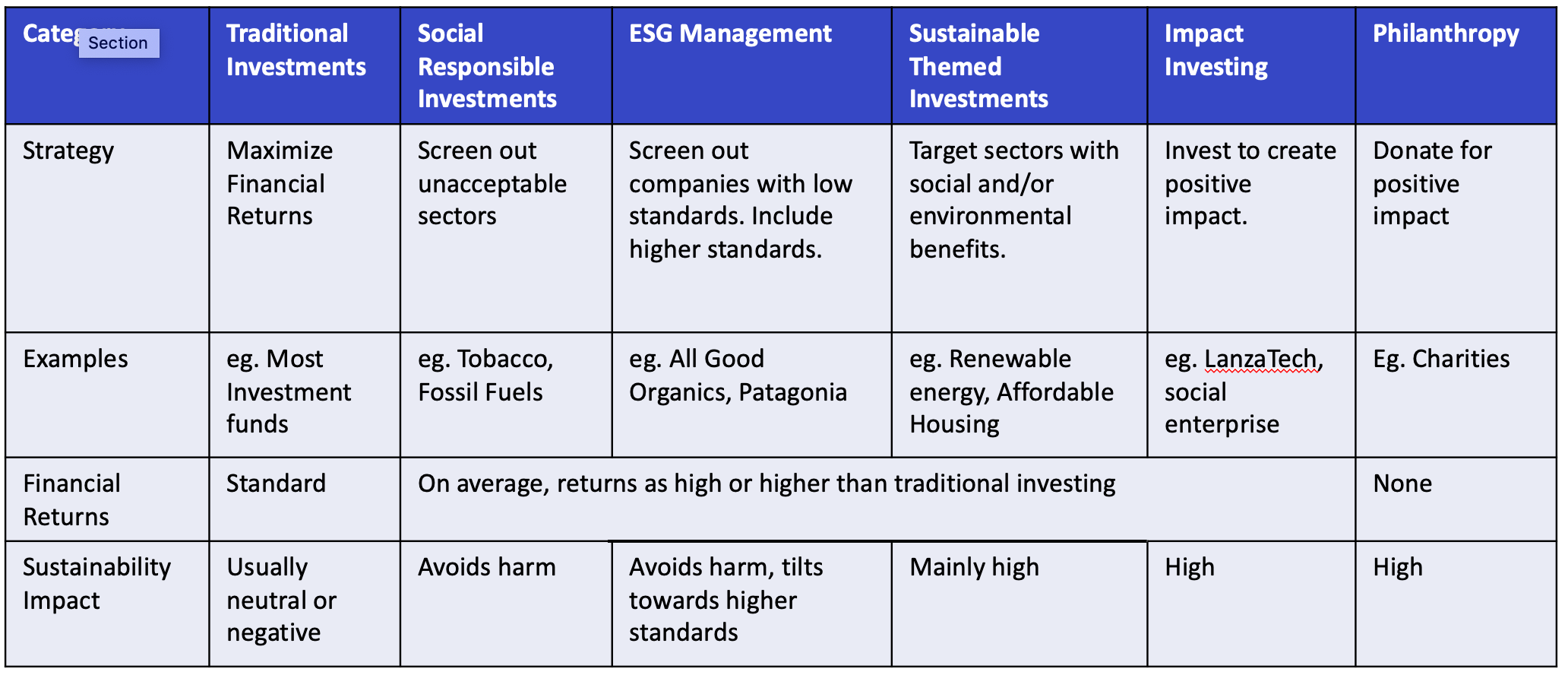

Responsible Investment Strategies

Avoiding: Socially Responsible Investment (negative screening of sectors or companies)

Higher Standards: ESG (Environment, Social and Governance) Management

Positive Impact: Sustainability themed investing or Impact Investing (doing good for people and/or the environment)

As well as the social and environmental impacts, there has been greater attention paid to the ways that companies are governed and managed. ESG management should also embody active corporate governance to raise the standards of companies.

These terms can be confusing and make it difficult for investors to understand ethical investing. There are risks of greenwashing because most funds claim to invest responsibly. In order to cut through the unsubstantiated claims, Mindful Money uses clear criteria, with verification and certification processes to ensure that the funds on this platform meet our high ethical standards (see Methodology section).

Negative Screening

Screening out undesirable companies (also known as ethical investment) is not new. The Quakers refused to support companies engaged in the slave trade 300 years ago. A boycott of companies invested in South Africa was a key part of the anti-apartheid movement.

In 2016, New Zealand holders of KiwiSaver accounts were shocked to hear that some of their money was being invested in corporations making landmines or cluster bombs, nuclear weapons or tobacco. Under public pressure, the managers of most KiwiSaver funds excluded arms and tobacco from their portfolios – this is called sector exclusions or negative screening.

In New Zealand, exclusions of tobacco and controversial weapons (landmines, cluster bombs and nuclear weapons) are now widely used, but not by all funds. Using the results of our consumer survey in 2018, Mindful Money has analysed all KiwiSaver funds on the basis of ten issues of concern to most New Zealanders:

- Tobacco

- Gambling

- Pornography/Adult Entertainment

- Alcohol

- Exploration and production of fossil fuels

- Weapons

- Palm Oil production

- GMOs

- Environmental Damage and Human Rights violations

- Animal Welfare

These issues have been measured in follow-up surveys in 2019 and 2020 - they remain core issues of public concern.

In each of these sectors, more than 63% of the public wanted their KiwiSaver fund to avoid investing (up to 93% for animal cruelty and human rights violations).

Yet Mindful Money analysis showed in 2019 that only 1% of funds have a policy to exclude the 'sin stocks' (tobacco, alcohol, gambling and pornography), and only 2% have a policy to avoid investing in fossil fuels. The transparency that Mindful Money has provided, and the growth of ethical investing, have encouraged fund providers to stregntehn their exclusions. By end March 2021, 15% of KiwiSaver funds had exclusions for fossil fuels.

Exclusion through divestment has traditionally been focused on excluding 'sin stocks' on moral and religious grounds. However, there has been a powerful divestment campaign focused on fossil fuels in recent years, led by the climate change campaign group 350.org. By the start of 2021, almost US$14 trillion had been divested from companies involved in fossil fuel exploration and extraction.

In New Zealand, the 350 Aotearoa campaign and a range of community groups, NGOs and investment sector activists have helped to persuade Anglican and Presbyterian churches, Otago and Victoria Universities, and Auckland, Christchurch and Dunedin Councils to divest.

At this scale, divestment has a real impact on the fossil fuels companies. The investment bank, Goldman Sachs, has not been a cheerleader for divestment but they have said the “divestment movement has been a key driver of the coal sector’s 60% de-rating over the past five years”.

On this platform, you can use the Fund Finder to avoid the above sectors of concern or company practices that violate basic norms, or you can jump to the Quick Invest pages to go Fossil Free, Sin Free or Weapons Free.

Better companies

There has been huge growth worldwide in analysis of the Environment, Social and Governance (ESG) performance of companies. This is intended to not only weed out companies that breach acceptable standards, but also tilt the investment portfolio towards companies with higher standards.

The growth of ESG as an important investment management strategy has been shown by the rise in membership of the UN-linked Principles of Responsible Investment (PRI). Their members manage assets totalling around $US120 trillion (in early 2021). Those members have made a commitment to manage their funds according to ESG principles.

The use of ESG ratings by investment providers has been facilitated by research and rating agencies that score the larger listed companies around the world according to ESG measures. MSCI, one of the largest agencies, analyses 37 key issues, divided into ten themes. The other main ratings agency, Sustainalytics, provides a two-dimensional lens: the exposure lens shows the risks the company is facing and the management lens reports how well the company is performing in managing the risks.

The use of ESG has become common amongst New Zealand fund managers, as well as their international counterparts. Most KiwiSaver providers and managers of other investment funds have some form of ESG management applying to at least some of their funds. Some say there is little credible information to back up the claims of ESG management, and a serious risk of greenwashing.

Mindful Money takes a rigorous approach to ESG to provide assurances to the public. These are outlined in the Methodology section of this website. This provides assurances that claims made by fund providers on this website have been tested and assured by the only credible certification agency, the Responsible Investment Association of Australasia (RIAA). A listing of the funds with certified ESG practices are on our Higher Standards page.

Sustainability-Themed Investing

Sustainability themed funds invest in sectors where there are likely to be social and environmental benefits. These include renewable energy, clean technology, clean and affordable water, affordable housing, sustainable transport, low impact and organic agriculture, native forest conservation and planting, and green buildings.

The range of potential themes is huge. Some funds are now linking their investment outcomes to the 17 UN Sustainable Development Goals. These provide a powerful and broad framework, but credible themed investing also needs evidence of positive impact.

Impact Investment

While most forms of Responsible Investment focus on avoiding damage, impact investing aims to create positive impact through funding companies or projects that have social and/or environmental benefits, as well as a financial return.

There are impact funds that have a comparable return to investments with similar risks, but many investors are willing to accept a lower financial return for investments that do good. Generally financial returns are lower for impact investing. Microfinance is one area where there has been long term data on the returns over a long period. Triodos Microfinance Fund managed by Triodos Investment Management, a subsidiary of Netherlands based Triodos Bank, reported annual returns in Euro of 7.8 to 8.7% in 2012 with returns since inception in 2009 of 4.9 – 5.4%.

Definitions of impact investment are important. The Global Impact Investing Network (GIIN) defines impact investments as: …investments made into companies, organizations, and funds with the intention to generate measurable social and environmental impact alongside a financial return. The Impact Investing Network has been established to share experience and promote impact investment in New Zealand.

While it may seem that New Zealand has relatively small impact investments, such as community projects or income-earning social enterprises like Eat my Lunch, there are a range of investments that are not identified as impact funds - eg. native forests that generate a financial return as well as watershed protection and biodiversity benefits; sustainable transport projects that reduce emissions and offer transport choices; and affordable housing projects that provide housing for those in need.

There are now several impact funds in New Zealand, but they are only open to professional investors. Mindful Money plans to create a directory for retail investors who want to invest part of their discretionary funds in impact investments. While there are as yet no retail funds or KiwiSaver accounts focused on impact investing, there are other ways that individuals can get involved. Mindful Money's aim is to make this information available on an updated version of this platform later in 2021.

Active Corporate Governance

Most of the shares in companies worldwide are held by big ‘institutional investors’. These include banks, insurance companies, pension funds (such as NZ Superannuation Fund), and investment funds. They are effectively the owners of the companies, and they provide (or should provide) the corporate governance.

Most of those institutional investors track the short term earnings very closely (partly because their bonuses are often tied to increases or decreases in share prices) but ignore what impact their companies are having on the environment or societies.

However, some investment funds are active shareholders, raising issues with companies directly, joining with others in groups (such as through the Principles on Responsible Investment) or through taking action, such as by supporting shareholder resolutions or voting particular Directors off the Board. This is crucial in order to hold corporates to account and improve their performance.

Mindful Money plans to work with like-minded organisations to strengthen corporate governance in New Zealand, to ensure that company Directors are held to account for the social and environmental impacts of the companies they govern.

Certification

Around 30% of global investment is now managed by funds that have signed up to Principles for Responsible Investment (PRI). However, most signatories still invest in companies that harm our planet and our people. In recent years, members of PRI have been required to submit annual reports but these are not assessed against clear standards of responsible investment.

Studies find wide differences in the practices of responsible investment. Until recently there have been few measurable standards, particularly for ESG management, and no verification. Research has found too many cases of unsubstantiated claims. A report Winners and Spinners found ethical funds investing in companies with poor track record of ethical practice, including companies such as Rio Tinto and Shell.

The Responsible Investment Association of Australasia (RIAA) is the first organisation internationally to develop standards and processes to certify responsible investment funds. Their certification requires disclosure of all companies in the portfolio, third party assurance of internal processes and RI claims, and a ‘reasonableness test’ of the RI strategy.

As RIAA explains: “Because there are simply so many different approaches to investing (and interests that people have in it), we haven’t set out to define responsible or ethical investing or standards. Instead, we’ve served up our member’s certified products with a large dose of transparency and independent verification, so that you the consumer can draw your own conclusions from reliable information and choose investments that best suit your individual needs.”

Other forms of verification, including other certification schemes are likely to be developed in forthcoming years, especially alongside the EU's process to define the characteristics of sustainable practices. Mindful Money will include those that incorporate high standards and clear forms of verification.